Let an expert guide you through the process

Get the help you need!

For most it’s not enough to simply go through a self-paced course. Think about it this way, personal finance is no different than most any area of our life.

For example, if we wanted to be physically fit, we’d think about the best types of food, proper sleep, best exercises, equipment and probably enroll at a gym. But even though the fitness industry is a multi-billion-dollar industry, it’s no secret people statistically aren’t getting into better shape.

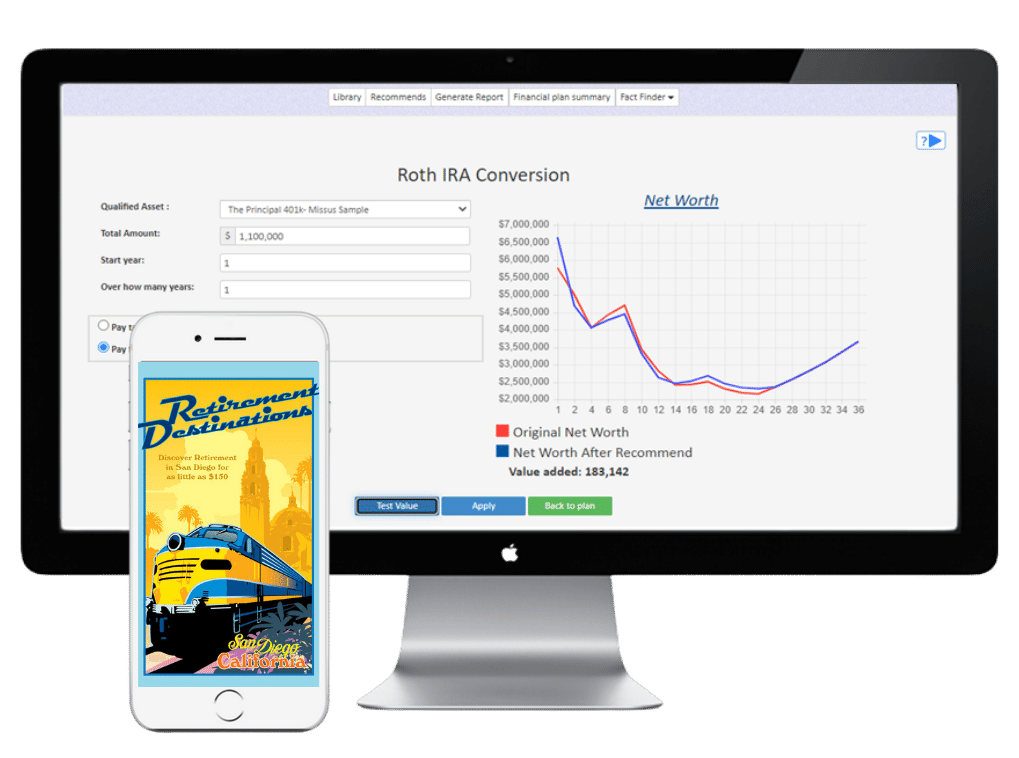

Parting with a dollar to fix a problem is the easy part. Where the REAL progress takes place is in the change of habits, behaviors and execution with a world class financial tool like Retirement Destinations™ and this is what our one-on-one coaching offers.